Highlights:

DMJPS is pleased to provide a statewide quarterly economic report with highlights of North Carolina’s fifteen metros for the first quarter of 2024. The state’s indicators point to overall steady but moderate growth, with churn among industry employment patterns.

• In the first quarter of 2024, North Carolina added approximately 70,000 jobs year-over-year for an average of 4.9 million employees. The state’s 1.4 percent gain was slightly less than the national 1.8 percent increase.

• At 2.6 percent, the Raleigh metro had the greatest rate of increase in employment in the first quarter when compared to the prior year. The Wilmington and Burlington metros followed closely at 2.4 percent each.

• North Carolina’s first quarter average unemployment rate of 3.7 percent was lower than the national average of 4.1 percent. Among the state’s fifteen metros, Asheville had the lowest first quarter unemployment rate at 3.0 percent while Rocky Mount had the highest at 5.0 percent.

• The Education and Health Services industry led first quarter employment growth year-over-year in North Carolina. Retail Trade estimated a first quarter loss of 1,300 jobs compared to the prior year.

• The private industry average hourly wage in North Carolina rose to $31.96 in the first quarter of 2024. The Durham-Chapel Hill metro maintained a lead with an average of $36.25. Eight of the state’s 15 metros experienced a shift down compared to the first quarter of 2023.

• At 6.7 percent, North Carolina’s same-home annual appreciation rate in the first quarter slightly outpaced the national rate of 6.3 percent.

• Average taxable retail sales in North Carolina were $55.5 billion in the first quarter, a 3.2 percent increase year-over-year.

• Special feature, educational attainment: According to the U.S. Census Bureau, in North Carolina an estimated 35.9 percent of the population age 25 years and older had earned a bachelor’s degree or higher in 2022. This was up compared to five years prior.

Detailed Analysis:

Employment

In the first quarter of 2024, employment averaged roughly 4,951,000 employees in the state of North Carolina. This reflected an average percentage increase of 1.4 percent compared to the prior year, slightly lagging the national 1.8 percent (Figure 1). The state has not experienced a quarterly year-over-year loss since the first quarter of 2021.

Figure 1

North Carolina Total Employment

Monthly Year-to-Year

Percent Change

Source: US Bureau of Labor Statistics

Source: US Bureau of Labor Statistics

North Carolina’s fastest growing metro in the first quarter of 2024 was Raleigh with a 2.6 percent increase in employment when compared to a year earlier (Figure 2). This was followed by the Wilmington and Burlington metros at an increase of 2.4 percent each. The Greensboro-High Point, Rocky Mount, Asheville, Winston-Salem, and Hickory metros each experienced year-over-year growth rates below 1 percent, however, all of the state’s metros added employment with the exception of Hickory.

Figure 2

2024 1Q Average

North Carolina Metros

Employment One-Year Percent Change

Source: US Bureau of Labor Statistics

Source: US Bureau of Labor Statistics

North Carolina’s unemployment rate averaged 3.7 percent in the first quarter of 2024, lower when compared to the national 4.1 percent (Figure 3). This marked ten consecutive quarters where the state’s average unemployment rate dipped below four percent and five consecutive quarters where the state’s average was lower than the nation’s.

North Carolina’s first quarter average unemployment rate translated into roughly 193,146 people who were unemployed and looking for work, representing an increase of 1.8 percent compared to a year earlier.

Figure 3

North Carolina

Unemployment Rates (%)

Source: US Bureau of Labor Statistics

The Asheville metro had the lowest first quarter average unemployment rate at 3.0 percent, followed by Durham-Chapel Hill at 3.2 percent (Figure 4). Nine of the state’s metros experienced average unemployment rates that were below the state’s average 3.7 percent. Exceeding the national average of 4.1% for the first quarter average unemployment rate were Jacksonville (4.3%), Fayetteville (4.8%) and Rocky Mount (5.0%) metros.

Figure 4

North Carolina Metros

Unemployment Rate (%)

2024 1Q Average

Source: NC Department of Commerce

Source: NC Department of Commerce

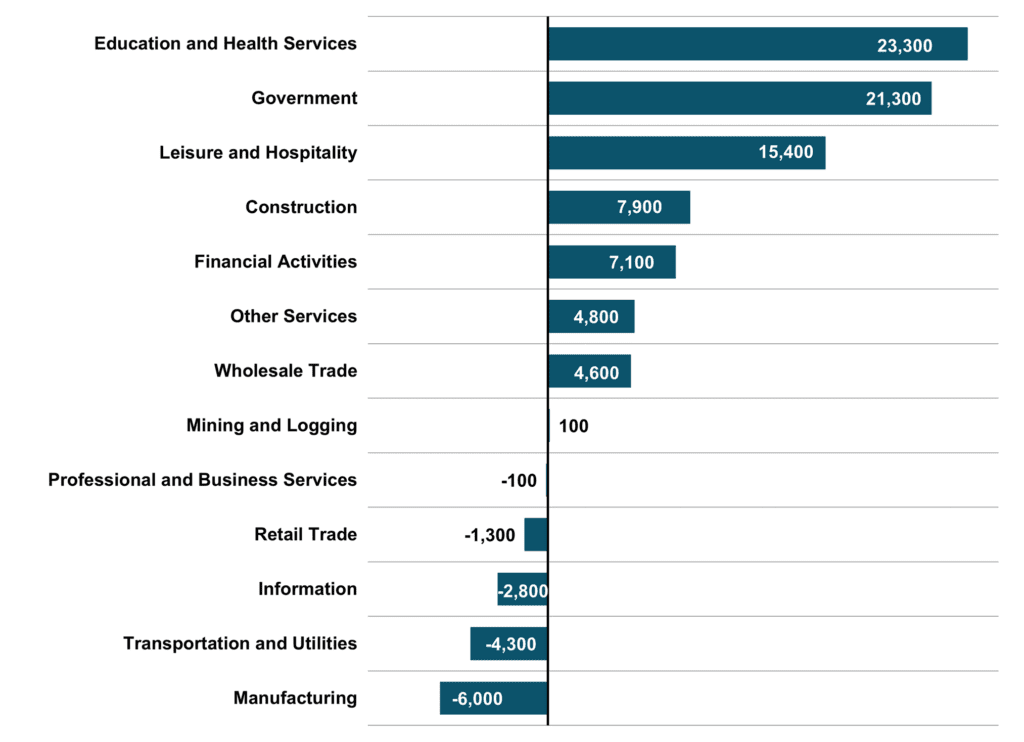

North Carolina had an overall gain of roughly 70,000 new jobs in the first quarter of 2024 compared to the prior year. Gains were led by Education and Health Services with 23,300 new jobs, followed by Government with 21,300 new jobs (Figure 5). Manufacturing experienced a loss of 6,000 jobs year-over-year. While Retail Trade had not experienced a quarterly year-over-year loss for 13 consecutive quarters, there was an estimated loss of 1,300 jobs in the first quarter of 2024 compared to the prior year.

Overall employment growth was a net positive despite year-over-year gains decreasing each quarter since the first quarter of 2023.

Figure 5

North Carolina – 2024 1Q

Major Industry Employment

One-Year Change

Totals rounded to nearest 100.

Totals rounded to nearest 100.

Source: US Bureau of Labor Statistics

Wages

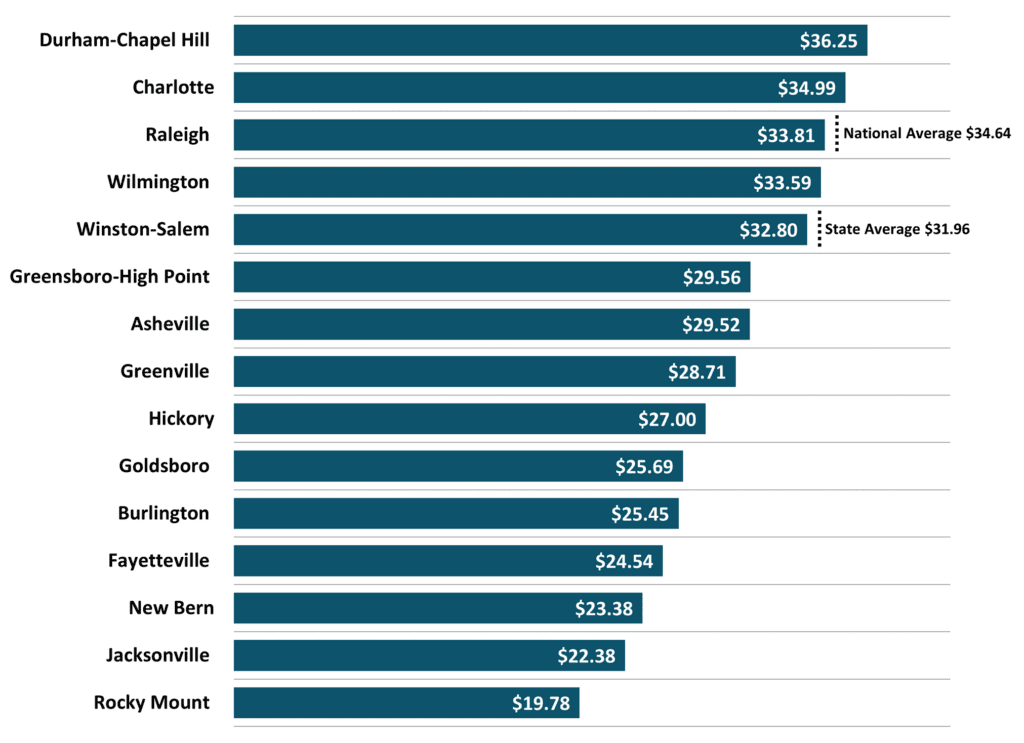

Private industry average hourly wages in North Carolina rose to $31.96 in the first quarter of 2024 for a 3.1 percent increase compared to the prior year (Figure 6). The growth rate continued to decelerate and the first quarter of 2022 represents the high point in terms of percentage increase looking back as far as 2008.

Figure 6

North Carolina

Average Hourly Wages

Private Industry

Source: NC Department of Commerce

Source: NC Department of Commerce

The Durham-Chapel Hill metro led the state’s fifteen metros with a first quarter average hourly wage of $36.25 (Figure 7). Five of the state’s fifteen metros exceeded the overall state average of $31.96. Additionally, two metros exceeded the national average of $34.64: Durham-Chapel Hill ($36.25) and Charlotte ($34.99). Rocky Mount metro’s first quarter average was the lowest of the state’s metros at $19.78. Eight of the state’s 15 metros experienced a downward shift compared to the first quarter of 2023: Greensboro-High Point, Greenville, Goldsboro, Burlington, Fayetteville, New Bern, Jacksonville, and Rocky Mount metros.

Figure 7

North Carolina Metros – 2024 1Q

Average Hourly Wages

Private Industry

Source: NC Department of Commerce

Source: NC Department of Commerce

Housing

At 6.7 percent, the state of North Carolina’s same-home annual appreciation rate in the first quarter slightly exceeded the national rate of 6.3 percent (Figure 8). Burlington metro ranked first among the state’s fifteen metros with a 12.4 percent appreciation rate. Eight metros exceeded the state average while the New Bern metro estimated a sharp decline and fell to -0.3 percent.

Figure 8

North Carolina Metros

Same-Home Annual Appreciation Rate (%)

2024 1Q

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

Permit activity for new residential building in the state of North Carolina totaled 23,278 units in the first quarter of 2024 with a value of $5,967,024,000 (Figure 9). In percentage terms, the total number of units permitted was down 1.7 percent compared to the prior year while the total value increased 12.5 percent. Permitted multi-family units totaled 5,864 and accounted for 25.2 percent of total units.

Figure 9

North Carolina

Estimated Residential Building Permits Activity*

*Based on a survey of permitting agencies. The Census Bureau provides estimates for

*Based on a survey of permitting agencies. The Census Bureau provides estimates for

any missing agency data, which typically amounts to less than 20% of the total permits.

Source: US Census Bureau

Retail Sales

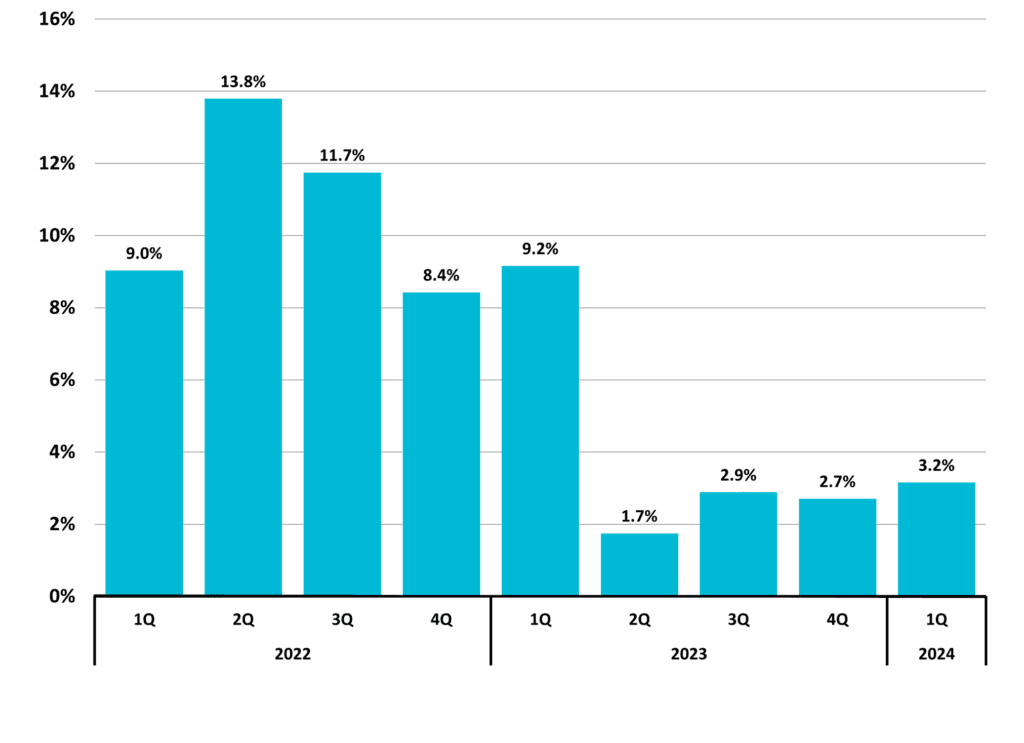

Taxable retail sales in North Carolina totaled $55,533,191,244 ($55.5 billion) in the first quarter of 2024 for a 3.2 percent increase compared to a year earlier (Figure 10 and Figure 11). First quarter 2024 taxable retail sales marked a high point when compared to any first quarter looking back five years, although the growth rate has cooled.

Figure 10

North Carolina

Total Taxable Retail Sales

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Source: NC Department of Revenue

Figure 11

North Carolina

Total Taxable Retail Sales

Quarterly Year-to-Year Change (%) Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Source: NC Department of Revenue

Special Feature:

Educational Attainment

According to the U.S. Census Bureau, in North Carolina approximately 35.9 percent of the population age 25 years and older held a bachelor’s degree or higher in 2022 (Figure 12). This was generally on par with the national 35.7 percent and up from 31.3 percent compared to five years prior.

Figure 12

North Carolina

Educational Attainment

Source: US Census Bureau

Source: US Census Bureau

The business landscape is complex. Need help? Contact DMJPS.

For a printer-friendly version, click here.