The Tax Cuts and Jobs Act (TCJA) of 2017 made sweeping changes to the Internal Revenue Code (IRC). It lowered tax rates for individuals, businesses and families. Some provisions of the statute are intended to discourage businesses from moving assets overseas. Many of the changes made by the TCJA will expire at the end of 2025 unless Congress acts to extend them or make them permanent. Whether this will happen largely depends on the outcome of the election in November 2024. For now, taxpayers can begin planning for 2025 and beyond based on the schedule provided by the TCJA.

Individual Tax Provisions

Numerous provisions affecting individual taxpayers will expire on December 31, 2025 under current law.

Individual Tax Rates

The TCJA lowered individual federal income tax rates for all tax brackets beginning on January 1, 2018. At the beginning of 2026, those rates will revert to their pre-2018 levels. The tax rates for unmarried individuals, for example, will change as follows:

Deduction for Pass-Through Business Income

The TCJA created a deduction based on qualified business income (QBI) from pass-through business entities, such as sole proprietorships, partnerships or limited liability companies (LLCs). QBI is based on net income from business activities earned within the U.S. with some exceptions. The deduction is equal to 20 percent of QBI.

Taxpayers whose taxable income is below the threshold amount may claim this deduction for most types of businesses that meet the above criteria. The threshold amounts for 2024 are $315,000 for married couples filing jointly and $157,500 for everyone else. Above those amounts, only certain types of businesses may qualify.

Under § 199A(i) of the IRC, the QBI deduction will expire on December 31, 2025.

Enhanced Child Credit

The TCJA raised the Child Tax Credit to $2,000 starting in 2018. The increase specifically only applies to tax years 2018 through 2025. In 2026, the amount of the credit will return to $1,000.

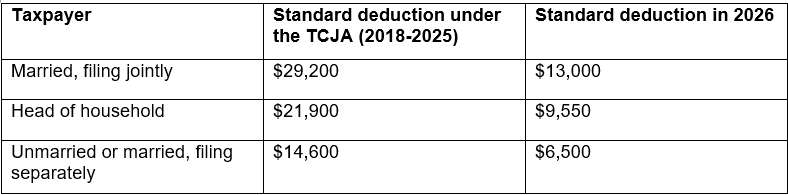

Standard Deductions

The standard deduction amounts for individuals and families increased on January 1, 2018. Standard deduction under the TCJA(2018):

Corporate Tax Rate

The corporate tax rate has been 21 percent since 2018. The TCJA did not include any provision limiting the duration of this change. Congress may decide to change the rate again, but it would need a new tax law to do so.

Estate and Gift Tax Planning

As part of the TCJA, the estate and gift tax exemption amounts were significantly increased, allowing individuals to transfer up to $12.92 million and married couples up to $25.84 million without triggering federal estate or gift taxes. These amounts are scheduled to revert to approximately $5 million (adjusted for inflation) per individual in 2026. This reduction presents a critical planning opportunity for those with larger estates.

– To maximize the current exemptions, consider strategies such as making annual exclusion gifts, funding 529 education plans, or establishing irrevocable trusts such as irrevocable life insurance trusts (ILITs).

Income and Capital Gains Tax Strategies

With individual tax rates set to increase after 2025, taxpayers might want to explore accelerating income or realizing capital gains while the current lower rates are in effect.

– Converting traditional IRAs to Roth IRAs before the rates increase is one strategy to consider, as Roth IRAs offer tax-free growth and distributions. Harvesting capital gains now, especially on highly appreciated assets, can also be beneficial. By selling and repurchasing the same securities, you can reset the cost basis and potentially reduce future tax liabilities.

Alternative Minimum Tax (AMT)

The AMT exemption amounts were increased under the TCJA but are scheduled to decrease after 2025, potentially subjecting more taxpayers to AMT.

– To mitigate this impact, consider accelerating income into years with higher exemptions, managing deductions that are disallowed under AMT, such as SALT, and maximizing charitable contributions. Additionally, strategies such as converting traditional IRAs to Roth IRAs before 2026 and timing your deductions can help minimize AMT liability. Various deductions, like those for state and local taxes, casualty and theft losses, and moving expenses, will revert to their pre-TCJA rules.

Corporate Tax Provisions

The TCJA made some permanent changes to corporate tax law, while others are scheduled to expire or change in 2026.

If you have any questions or would like additional information, please contact DMJPS CPAs + Advisors.