On July 4, 2025, the 2025 Tax Act was enacted with the President’s signature. Formerly and commonly referred to as the One Big Beautiful Bill (hereafter, the Act), the Act passed the legislative bodies on a party-line vote of 51-50 in the Senate and 218-214 in the House. Since the Act was signed on July 4, this is the date of enactment for specific effective dates in this Act.

The Act began largely as an extension of the Tax Cuts and Jobs Act of 2017 (TCJA) provisions, which was the President’s signature tax legislative accomplishment of his first term. However, this Act became much more, including a vehicle to enact several of Mr. Trump’s 2024 campaign promises in terms of new ideas and repealing others.

The legislative process for the Act was somewhat novel. The House passed its reconciliation bill on May 22, 2025, and the Senate passed its version on June 1, 2025. Normally, this results in a reconciliation conference committee tasked with reconciling the two very different measures. However, in this case, perhaps due to the self-imposed July 4 deadline for enactment, the House instead voted on the passed the Senate Bill intact, thereby bypassing the conference process, and sending the bill directly to the President for signature.

This also means that, in understanding this Act, the reader does not need to concern themselves with the provisions of the original House legislation or the fate of those provisions in the legislative process. Focus solely on the Senate bill since those measures were enacted.

There are also state issues in these changes. Many states “piggyback” from federal rules, meaning that you start with federal income or taxable income, and then make the adjustments required by that state. Thus, when the federal government changes any of these calculations, it indirectly changes many states as well. We do not yet know which of these provisions will be accepted by any state.

While there are many important non-tax provisions in the Act, this article focuses on those of tax importance to our personal tax clients. Also, this article does not cover every tax provision, but those of interest to the majority of our client readers. The items are presented in the author’s opinion of the order of relevance to our client base, or based on the author’s opinion of the logical sequence of the subject in relation to other items discussed.

Finally, note that the word “permanent” is featured many times in the Act and in this summary. In tax legislation, permanent means that the provision is not scheduled to expire in the future. This does not mean that the federal government has promised that this rule will always remain. Tax provisions are permanent only until a new Congress decides to change the rule in a way that is more negative or positive to taxpayers.

Business Tax Provisions

Commentary: Note that for calendar year 2025 taxpayers, property acquired 1/1/2025 to 1/19/2025 is not granted 100% bonus depreciation. Presumably, this property remains under the previous rule of 40% bonus depreciation for 2025.

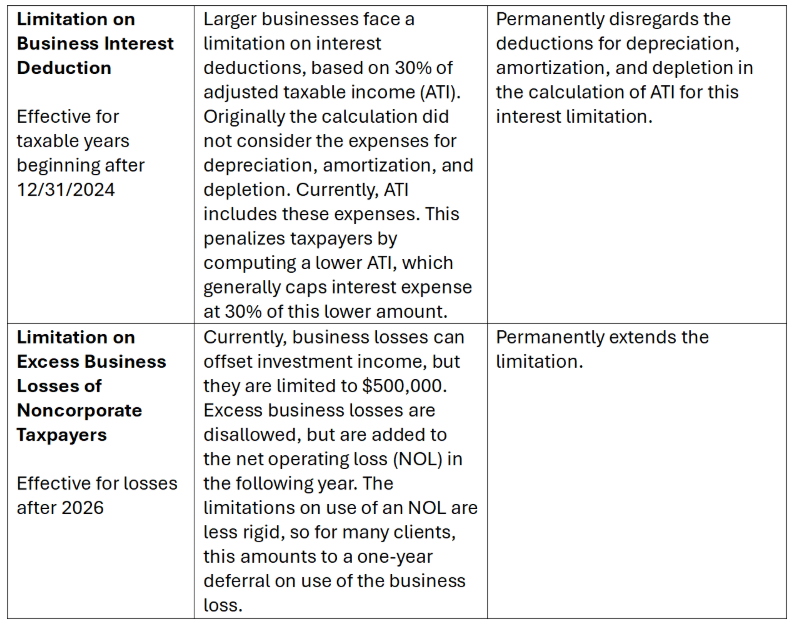

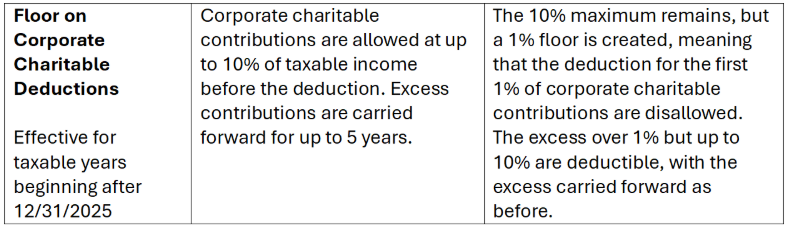

Commentary:

- The new $400 deduction is for “active” trades or businesses, apparently to distinguish from other Section 199A activities, which do not have an “active” requirement.

- Note that the House bill proposed increasing the deduction rate to 23%. This did not make it into the final bill.

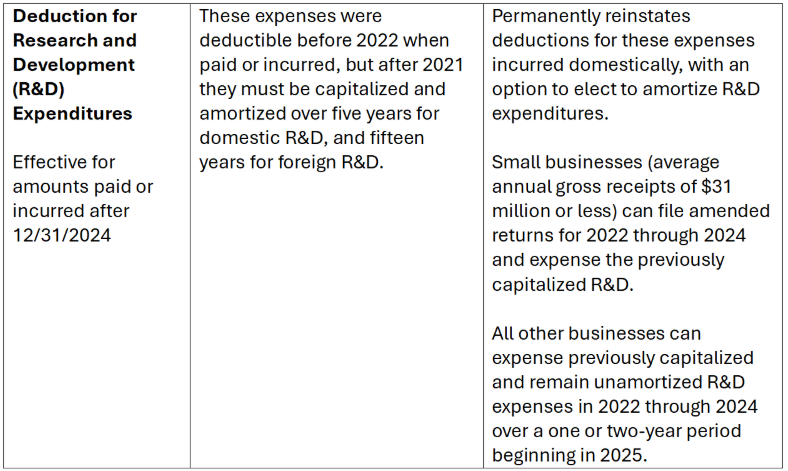

Commentary:

- Foreign research must still be capitalized and amortized over fifteen years.

- The deduction of the 2022, 2023, and 2024 R&D costs will be a change in accounting method, which may require filing a Form 3115 or some other disclosure that the Treasury Department may require.

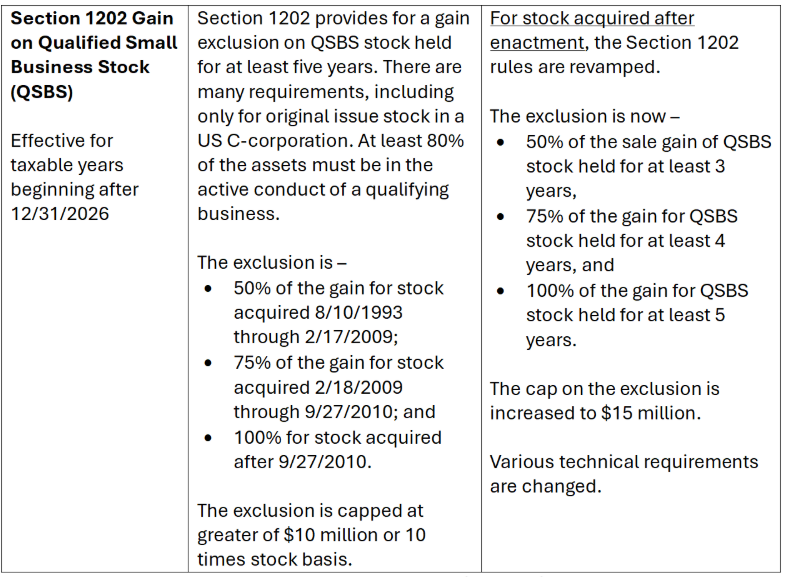

Commentary: Before the Act, taxpayers had three gain exclusion rules based on the date acquired. The new rule creates a fourth rule in addition to the prior three ones. The new rules will not be seen until 2028 because they would apply to stock acquired after 7/4/2025 and held for at least three years.

Commentary: The deduction remains, but only for buildings beginning construction for about one year after enactment.

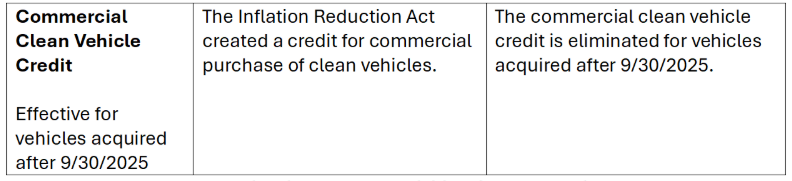

Commentary: If such a vehicle is on your acquisition list, move quickly.

Again, this represents a summary of the key business provisions in the 2025 Tax Act, as they would affect most of our business clients. This is not a comprehensive analysis of every provision, tax or non-tax. Please consider reading our summary of the article on key personal tax provisions, as some provisions in that coverage may also be of interest. Also, there may be cases where a provision is both personal and business in nature, and the new rule that you are looking for is in the other article.

Contact us if you have any questions about these law changes.