Highlights:

DMJPS is pleased to provide a statewide quarterly economic report for North Carolina. In the second quarter of 2022, the state of North Carolina experienced positive gains across the majority of economic indicators. Asheville metro led second quarter year-over-year employment gains among N.C.’s 15 metro areas. Asheville, Durham-Chapel Hill, and Raleigh metros tied as having the lowest unemployment rate in the state. Charlotte metro led North Carolina’s metros in average hourly wages with an average wage higher than both the state and nation. Raleigh metro led state metros in the same-home appreciation rate change year-over-year.

- In the second quarter of 2022, the state of North Carolina gained an average 3.8 percent employment, or 174,900 jobs compared to a year earlier.

- Averaging 3.7 percent during the second quarter of 2022, North Carolina’s unemployment rate was greater than the national average of 3.5 percent. At 3.1 percent each, Asheville, Durham-Chapel Hill, and Raleigh metros had the lowest average unemployment rate among the state’s fifteen metros.

- All major industries with the exception of Mining and Logging added employment in the second quarter of 2022 when compared to a year earlier. Leisure and Hospitality led gains with approximately 49,500 new net jobs.

- North Carolina’s average hourly wage was $29.40 in the second quarter of 2022, a decline compared to the first quarter but an increase of 6.4 percent year-over-year. The Charlotte Metro led the state’s fifteen metros with an average hourly wage of $32.38 which was greater than the national average of $31.97.

- North Carolina’s second quarter 2022 same-home annual appreciation rate was up to 26.6 percent from a year earlier. The state’s appreciation rate was greater than the national average of 20.9 percent. The Raleigh Metro had the greatest rate of change at 31.3 percent, followed by the Durham-Chapel Hill Metro at 30.6 percent.

- Taxable retail sales in the state of North Carolina reached approximately $57.8 billion in the second quarter of 2022, a 13.8 percent increase compared to a year earlier.

- Special Feature: 2021 Annual Average Population in 2021, Charlotte was the largest metro with over 2.7 million people and Fayetteville metro had the largest population with a 38 percent increase from 2016-2021.

Detailed Analysis:

Employment

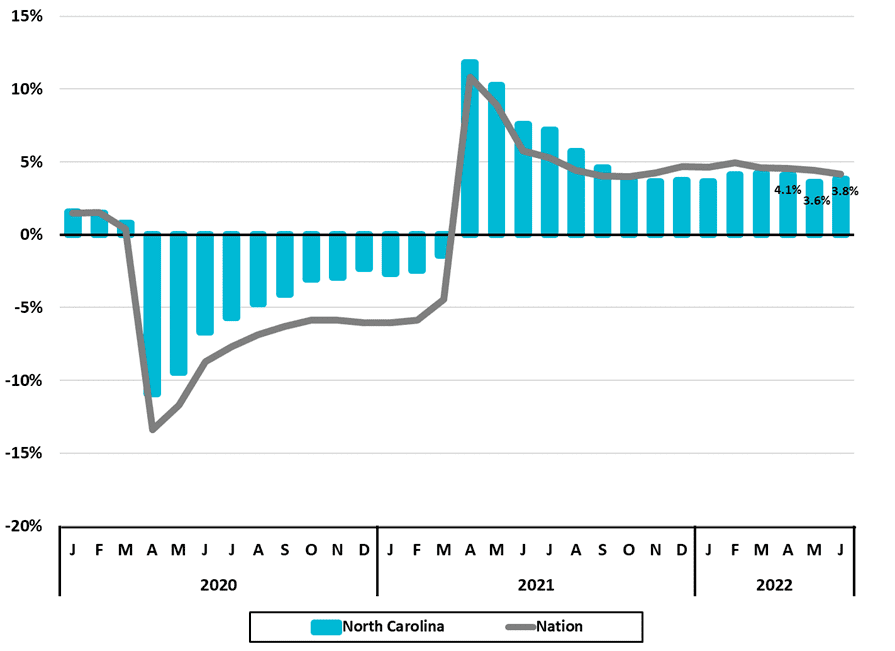

In the second quarter of 2022, employment in the state of North Carolina increased by an overall average of 3.8 percent (Figure 1 and Figure 2). This growth rate represented an average increase of approximately 174,900 jobs compared to a year prior. Additionally, the second quarter 2022 exceeded second quarter 2019, or pre-pandemic, employment. The nation’s growth rate averaged 4.4 percent year-over-year in the second quarter of 2022 and was slightly greater than the state (Figure 2).

Figure 1

Total Employment

Monthly Year-to-Year

Percent Change

Source: US Bureau of Labor Statistics

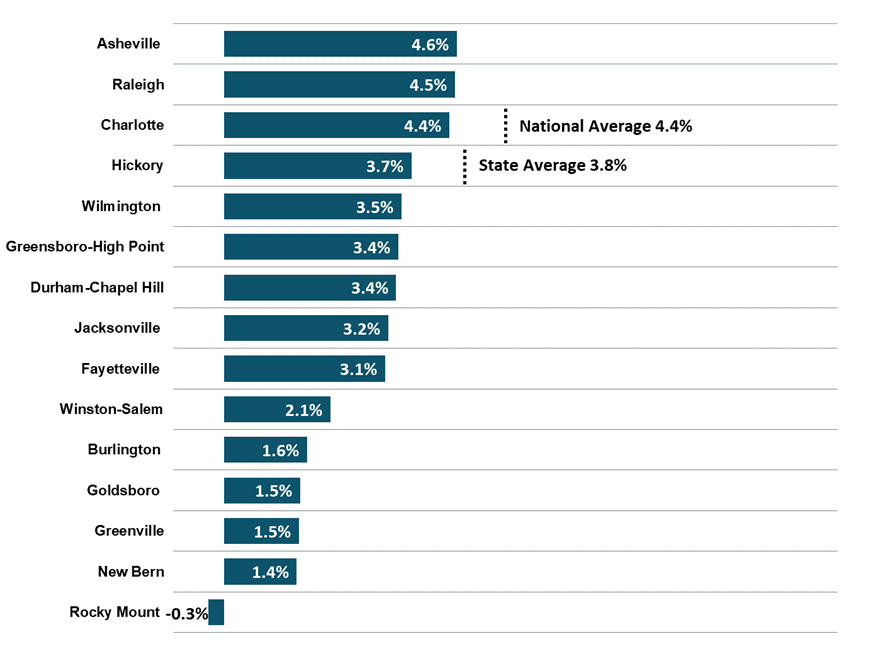

With the exception of the Rocky Mount Metro, each metro in the state of North Carolina gained employment in the second quarter compared to a year earlier, along with the state and nation (Figure 2). The state’s top three metros for percentage rate of employment gain over the second quarter were Asheville Metro (4.6 percent), Raleigh Metro 4.5 percent), and Charlotte Metro (4.4 percent). Each of the three metros outpaced the state’s overall growth rate of 3.8 percent. Additionally, the Asheville and Raleigh metros outpaced the nation’s overall 4.4 percent year-over-year increase in employment.

Figure 2

2022 2Q Average

North Carolina Metros

Employment One-Year Percent Change

Source: US Bureau of Labor Statistics

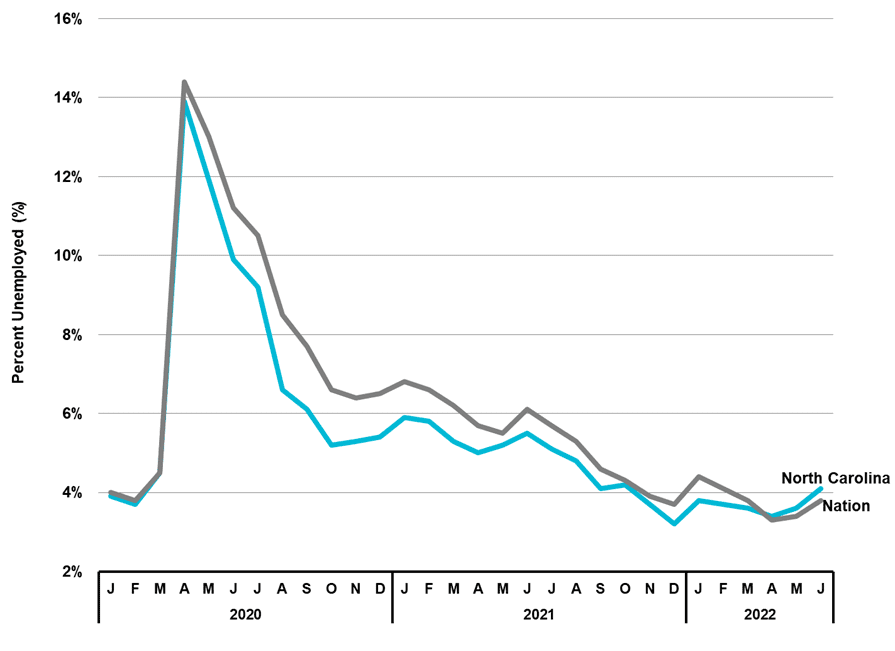

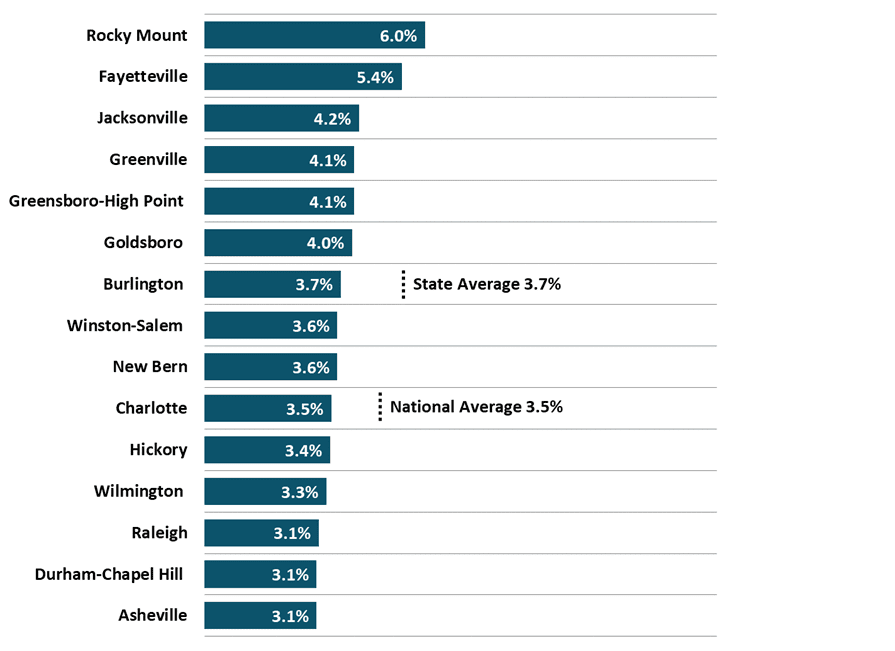

Averaging 3.7 percent over the second quarter of 2022, North Carolina’s unemployment rate was slightly higher compared to the national average of 3.5 percent (Figure 3 and Figure 4). The state’s unemployment rate increased each month in the second quarter of the year. The unemployment rate in the state translated into roughly 190,500 people who were unemployed, a decline of 26.3 percent compared to a year earlier. The state metros with the lowest unemployment rate at 3.1 percent each during the second quarter were Asheville, Durham-Chapel Hill, and Raleigh.

Figure 3

Unemployment Rate (%)

Source: NC Department of Commerce

Figure 4

Unemployment Rate (%)

2022 2Q Average

Source: NC Department of Commerce

In the second quarter of 2022, all major industries increased employment compared to one year earlier except for Mining and Logging in the state of North Carolina. Leisure and Hospitality’s net increase of 49,500 jobs and Professional and Business Services’ net increase of 48,100 jobs led overall employment gains and made up over half of the state’s total non-farm employment growth (Figure 5).

Figure 5

North Carolina – 2022 2Q

Major Industry Employment

One-Year Change

Totals rounded to nearest 100

Source: US Bureau of Labor Statistics

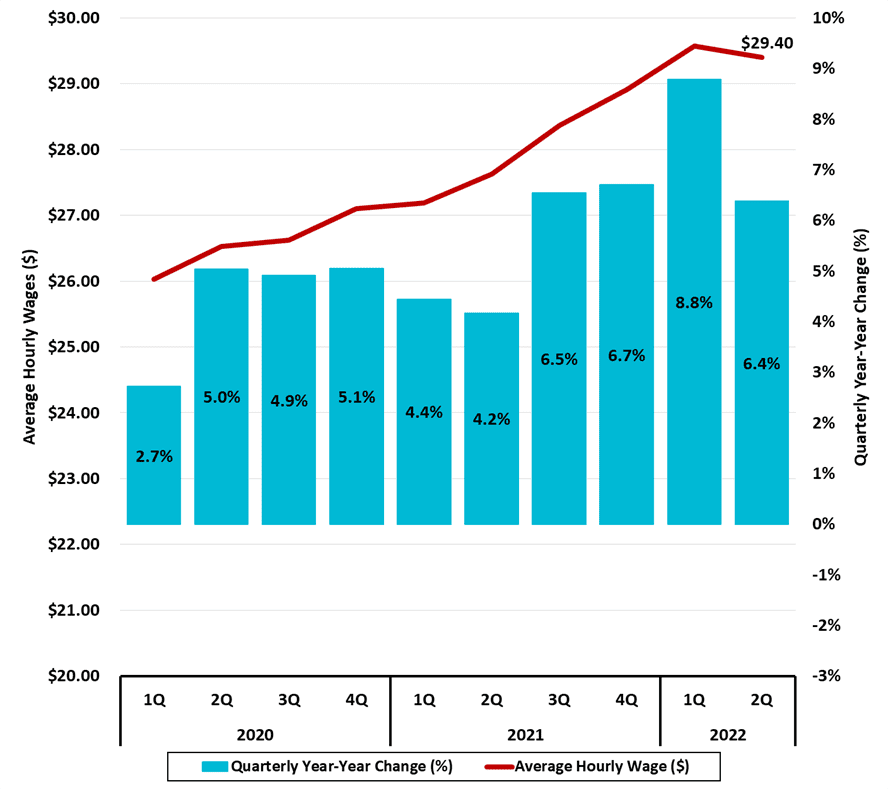

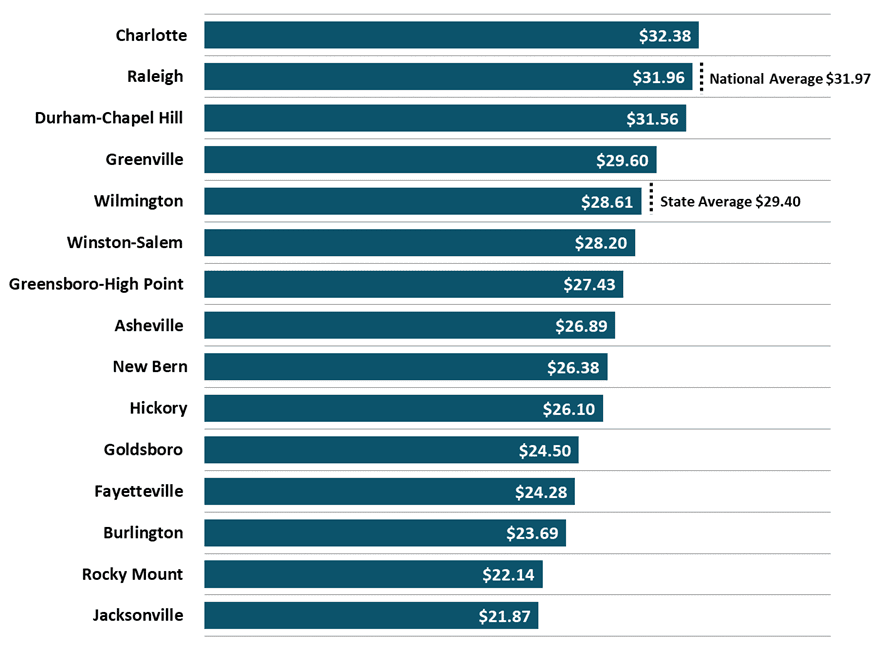

Wages

Private industry average hourly wages in the state of North Carolina averaged $29.40 in the second quarter 2022, a 6.4 percent increase from a year earlier (Figure 6). This marked a decline from the previous three quarterly year-over-year percentage gains. North Carolina metros with the highest average hourly wages were Charlotte ($32.38), Raleigh ($31.96), Durham-Chapel Hill ($31.56), and Greenville ($29.60). These four metros exceeded the overall state’s average of $29.40 while the Charlotte Metro also exceeded the national average of $31.97 (Figure 7).

Figure 6

North Carolina

Average Hourly Wages

Private Industry

Source: NC Department of Commerce

Figure 7

North Carolina Metros – 2022 2Q

Average Hourly Wages

Private Industry

Source: NC Department of Commerce

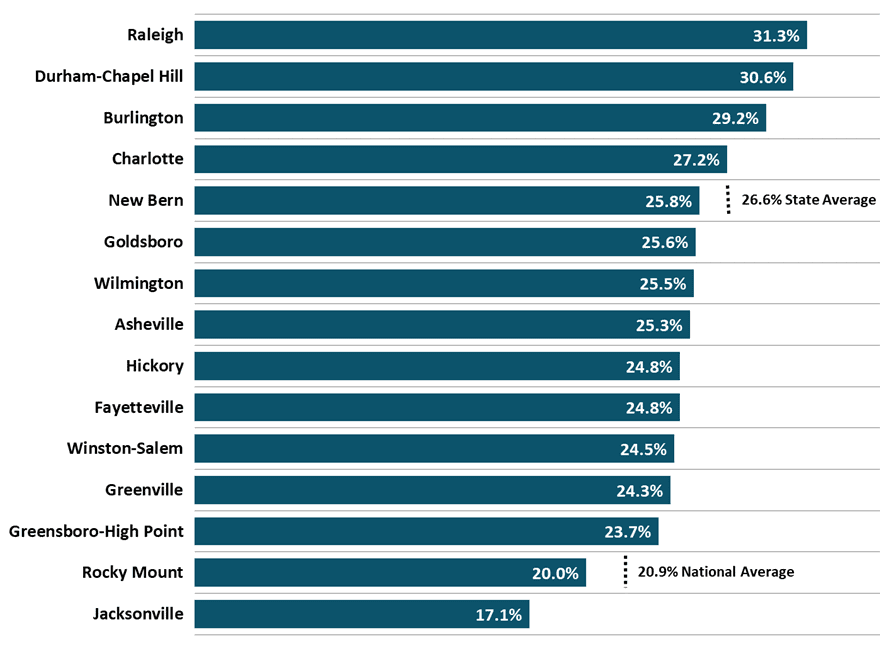

Housing

At 26.6 percent, the state of North Carolina’s Same-Home Annual Appreciation Rate surpassed the national rate of 20.9 percent in the second quarter of 2022 (Figure 8). North Carolina metros with appreciation rates that exceeded the state’s second quarter average included Raleigh (31.3 percent), Durham-Chapel Hill (30.6 percent), Burlington (29.2 percent), and Charlotte (27.2 percent). Except for the Jacksonville and Rocky Mount metros, all state metros exceeded the national average.

Figure 8

North Carolina Metros

Same-Home Annual Appreciation Rate (%)

2022 2Q

Source: Federal Reserve Bank of St. Louis

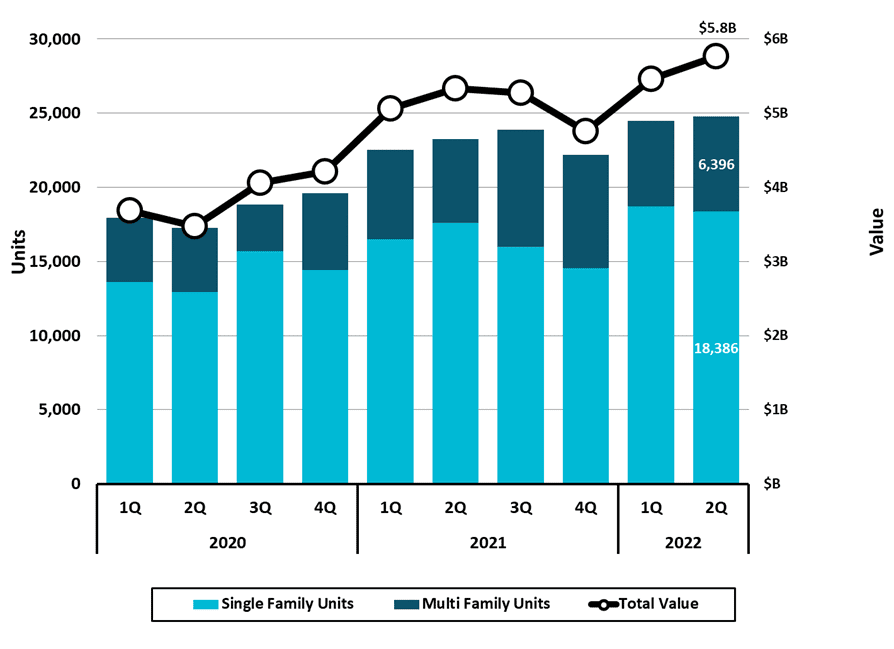

Estimated permit activity for new residential building in the state of North Carolina totaled 24,782 units in the second quarter of 2022 for single family and multi-family units combined (Figure 9). The total value of $5,770,183,000 ($5.8 billion) exceeded each quarter going back to at least 2020. In the second quarter, the total number of units permitted was up 6.7 percent and the total value was up 8.1 percent from one-year earlier. Permitted multi-family units totaled 6,396 and accounted for 25.8 percent of building permits.

Figure 9

North Carolina

Estimated Residential Building Permits Activity*

*Based on a survey of permitting agencies. The Census Bureau provides estimates for

*Based on a survey of permitting agencies. The Census Bureau provides estimates for

any missing agency data, which typically amounts to less than 20% of the total permits.

Source: US Census Bureau

Retail Sales

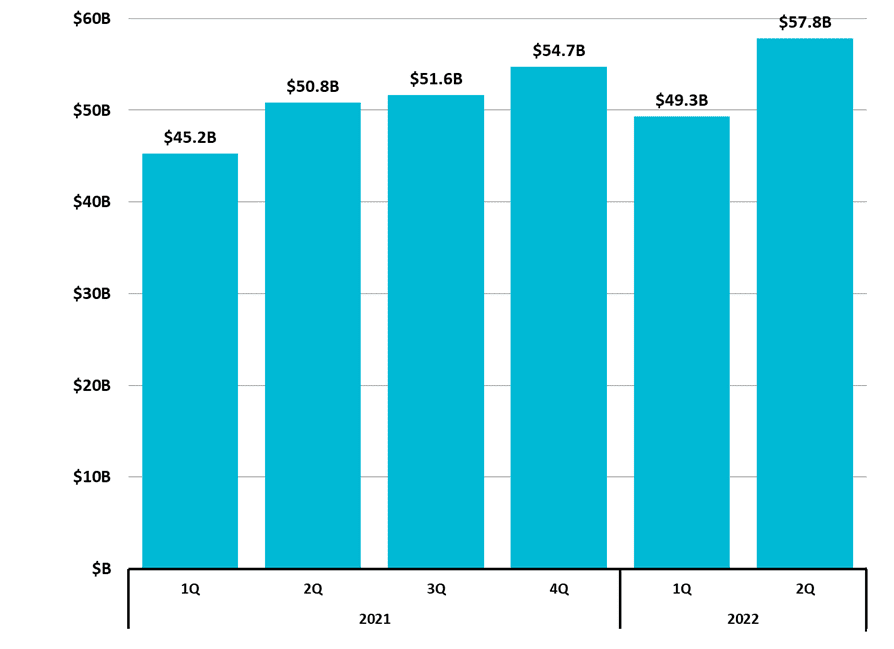

Taxable retail sales in the state of North Carolina totaled $57,818,573,071 ($57.8 billion) in the second quarter of 2022. This was higher than the previous five quarters and represented a 13.8 percent increase compared to a year earlier (Figure 10 and Figure 11).

Figure 10

North Carolina

Total Taxable Retail Sales

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Source: NC Department of Revenue

Figure 11

North Carolina

Total Taxable Retail Sales

Quarterly Year-to-Year Change (%)

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Source: NC Department of Revenue

Special Feature:

2021 Annual Population

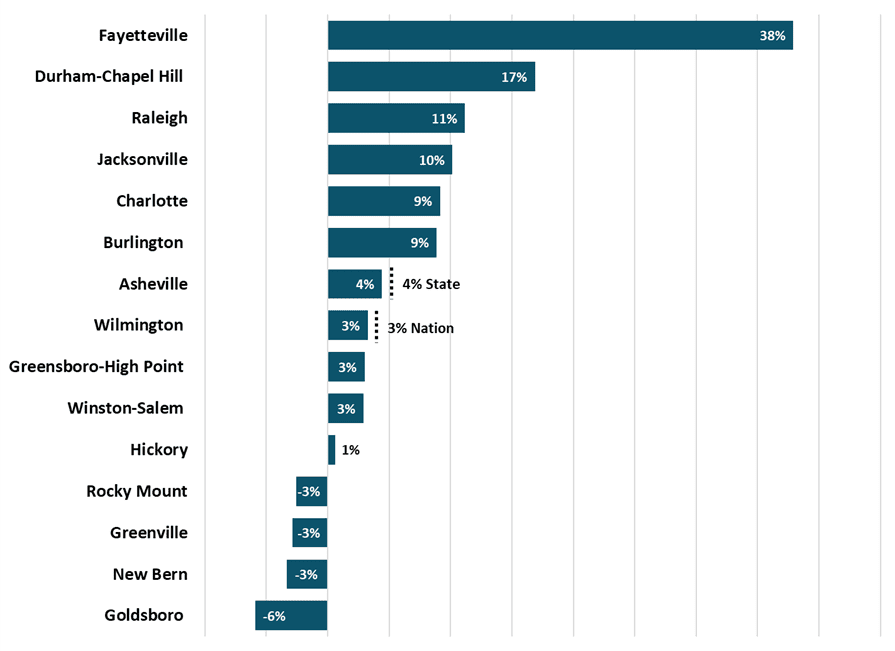

The population feature in this quarterly report is based on an annual estimate. In 2021, the Charlotte Metro was the largest metro with over 2.7 million people, followed by the Raleigh Metro with a population of over 1.4 million (Figure 12). From 2016-2021, the Fayetteville Metro had the largest percentage change in population, followed by Durham-Chapel Hill and Raleigh metros (Figure 13). Six of the fifteen North Carolina metros outpaced both the state’s overall 4 percent and the nation’s 3 percent increases. Rocky Mount, Greenville, New Bern, and Goldsboro were the only North Carolina metros that estimated declines in population from 2016-2021 and were also the four least populated metros in the state (Figure 12 and Figure 13).

Figure 12

North Carolina Metros

2021 Annual Population

Source: US Census Bureau

Figure 13

North Carolina Metros

Percentage Change in Population

2016-2021

Source: US Census Bureau

For a printer-friendly version, CLICK HERE.

End note: Data reflects a snapshot or point in time, September 2022, and may be subject to periodic adjustment.

Need help navigating your business? Contact DMJPS.