Highlights:

DMJPS is pleased to provide a statewide quarterly economic report with highlights of North Carolina’s fifteen metros for the 1st Quarter of 2023. Compared to first quarters historically, in various indicators we see new high points for first quarters reflected in 2023 Q1.

• In the first quarter of 2023, employment in the state of North Carolina was estimated at approximately 4.9 million, the highest first quarter average on record. Wilmington metro experienced 5.1 percent growth compared to a year earlier and topped the state’s fifteen metros.

• Averaging 3.6 percent over the first quarter of 2023, North Carolina’s unemployment rate was below the national average of 3.8 percent and marked the lowest first quarter unemployment rate for the state going back ten years. Asheville metro’s 3.0 percent unemployment rate was the lowest of the state’s metros.

• Private industry first quarter average hourly wages in the state rose to $30.99 for a 4.6 percent gain from a year earlier. Durham-Chapel Hill continued to lead the state’s metros with an average of $34.77.

• At 12.7 percent, North Carolina’s same-home annual appreciation rate was greater than the nation’s first quarter average of 8.1 percent. All of the state’s metros were at or above the national average while seven were above the state average as well.

• Estimated permit activity for new residential building in North Carolina totaled 23,676 units in the first quarter with a value of $5.3 billion.

• Taxable retail sales in North Carolina totaled $53.8 billion in the first quarter, a 9.2 percent increase compared to a year earlier.

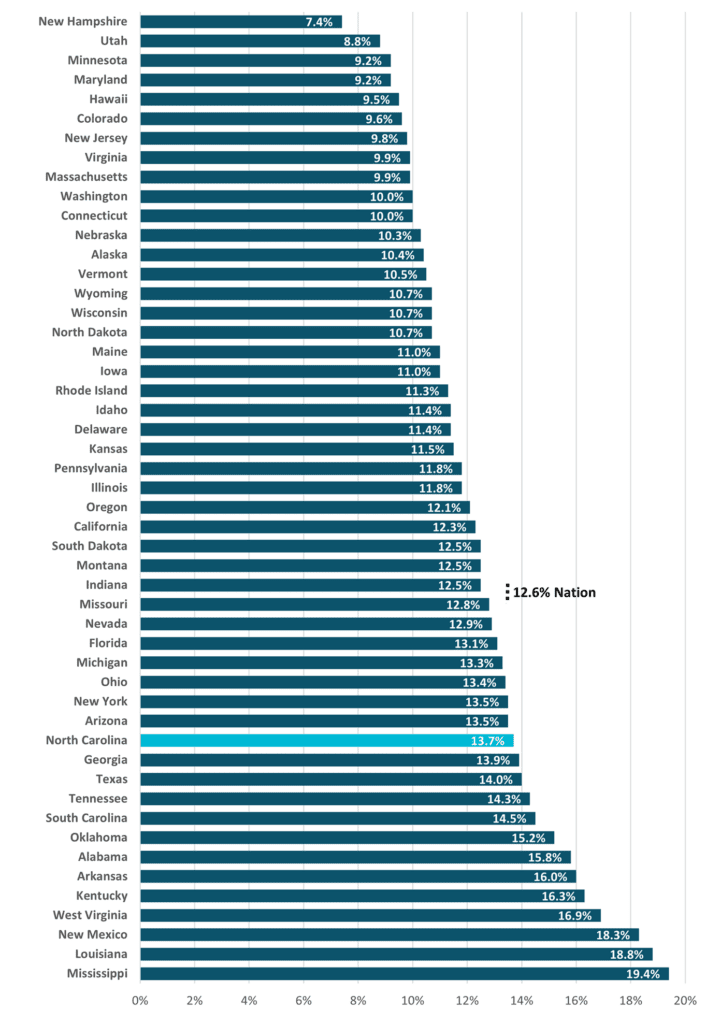

• Special feature, poverty rate: North Carolina’s 2021 poverty rate was 13.7 percent, a higher percentage compared to the nation’s 12.6 percent and thirteenth highest among the nation’s fifty states. However, the state’s poverty rate has decreased steadily since 2012.

Detailed Analysis:

Employment

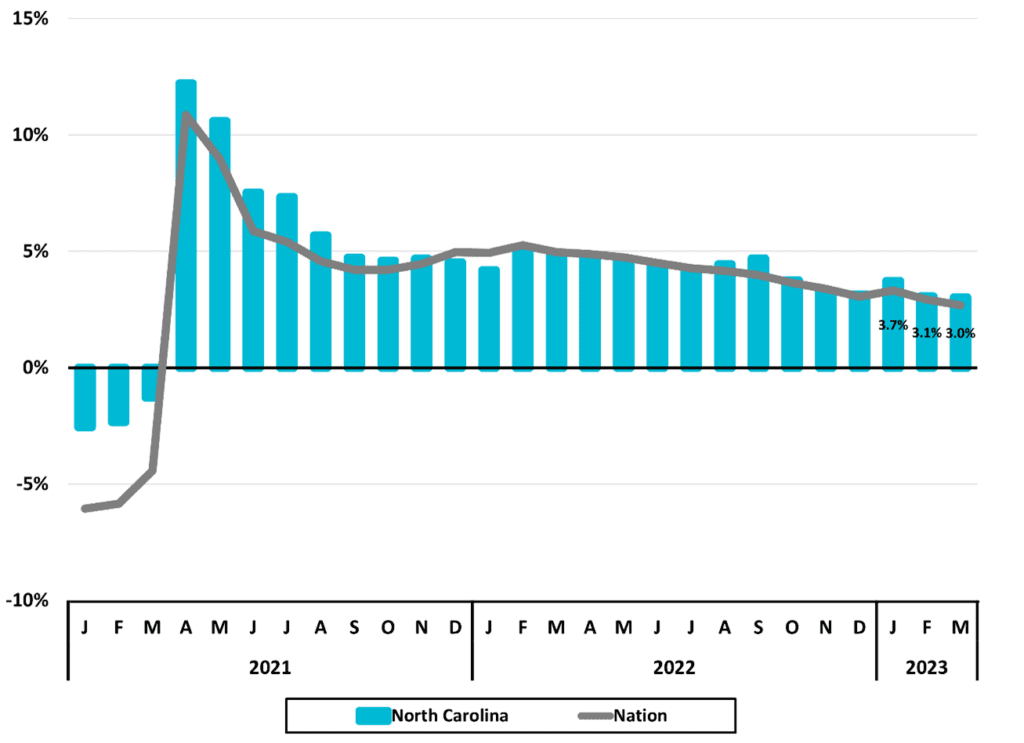

In the first quarter of 2023, employment averaged 4,853,700 employees in the state of North Carolina, the highest first quarter average for the state on record. Employment increased by an average of 3.3 percent (Figure 1) for a gain of 153,500 new jobs from a year earlier. Additionally, North Carolina’s growth rate outpaced the nation’s 3.0 percent.

Quarterly year-over-year gains have continued uninterrupted for two years.

Figure 1

Total Employment

Monthly Year-to-Year

Percent Change

Source: US Bureau of Labor Statistics

Source: US Bureau of Labor Statistics

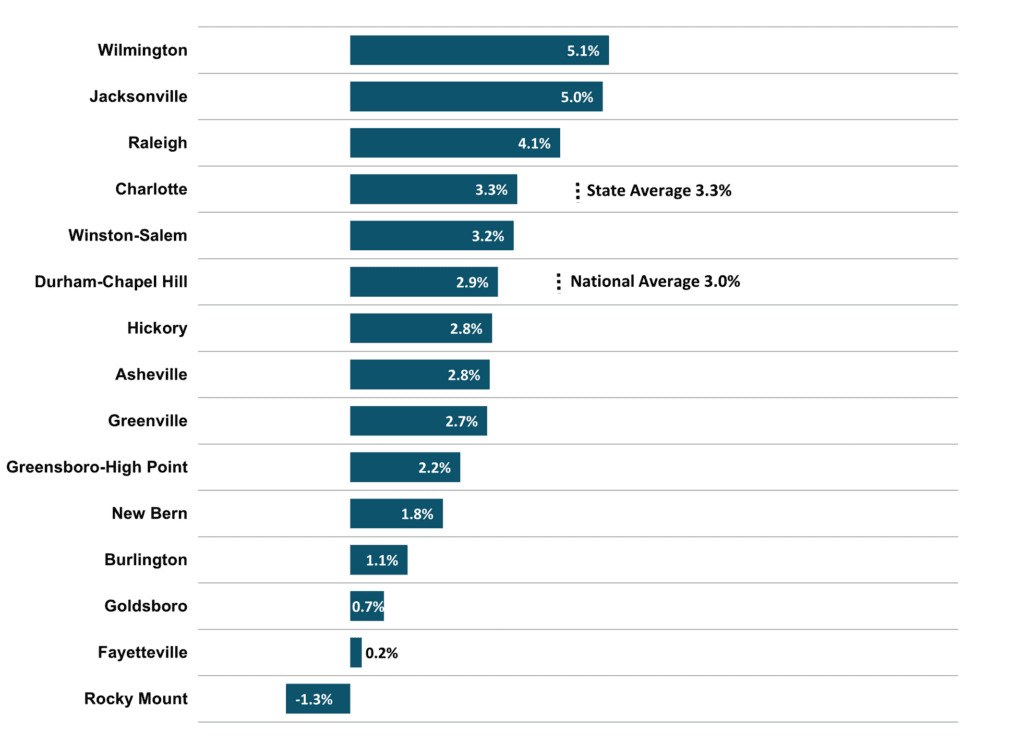

Each of North Carolina’s fifteen metros gained employment in the first quarter of 2023 compared to a year earlier, with the exception of Rocky Mount Metro (Figure 2). The state’s fastest growing metro was Wilmington with a 5.1 percent gain compared to a year earlier, followed by Jacksonville (5.0 percent) and Raleigh (4.1 percent). These three metros outpaced both the state’s overall 3.3 percent and the national 3.0 percent growth rates in the first quarter.

Figure 2

2023 1Q Average

North Carolina Metros

Employment One-Year Percent Change

Source: US Bureau of Labor Statistics

Source: US Bureau of Labor Statistics

North Carolina’s unemployment rate averaged 3.6 percent in the first quarter of 2023, just below the national average of 3.8 percent (Figure 3). This marks the lowest first quarter unemployment rate for the state going back ten years. The unemployment rate translated into approximately 187,150 residents unemployed, down roughly one percent compared to a year earlier.

Asheville metro had the lowest first quarter average unemployment rate of the fifteen state metros at 3.0 percent (Figure 4). Raleigh and Durham-Chapel Hill followed closely with 3.1 percent each. Seven of the fifteen metros had unemployment rates below the state’s overall 3.6 percent while Burlington metro matched the state.

Figure 3

North Carolina

Unemployment Rates (%)

Source: US Bureau of Labor Statistics

Source: US Bureau of Labor Statistics

Figure 4

North Carolina Metros

Unemployment Rate (%)

2023 1Q Average

Source: US Bureau of Labor Statistics

Source: US Bureau of Labor Statistics

Eleven of thirteen major industry sectors in North Carolina gained employment in the first quarter of 2023 when compared to one year earlier (Figure 5). Leisure and Hospitality led major industry growth with a net gain of 42,300 jobs. Professional and Business Services added 27,300 jobs; Private Education and Health Services followed closely with a gain of 27,200 jobs. Collectively, these three major industries made up 63 percent of the state’s overall year-to-year net gain in the first quarter.

Figure 5

North Carolina – 2023 1Q

Major Industry Employment

One-Year Change

Totals rounded to nearest 100.

Totals rounded to nearest 100.

Source: US Bureau of Labor Statistics

Wages

Private industry average hourly wages in North Carolina equaled $30.99 in the first quarter of 2023 (Figure 6). The state average has been rising and this marked a high point compared to any quarter dating back to 2007. While the state experienced a 4.6 percent increase compared to a year earlier, the rate of growth has decelerated since the first quarter of 2022.

Figure 6

North Carolina

Average Hourly Wages

Private Industry

Source: NC Department of Commerce

Source: NC Department of Commerce

Durham-Chapel Hill led the state’s fifteen metros with a first quarter 2023 average hourly wage of $34.77, roughly twelve percent greater than the overall state average (Figure 7). Both Durham-Chapel Hill and Charlotte metros exceeded the state and national averages. Raleigh and Greenville metros exceeded the state average at $32.85 and $31.61, respectively, but fell short of the national average. Eleven of the fifteen state metros fell below the state average in the first quarter.

Figure 7

North Carolina Metros – 2023 1Q

Average Hourly Wages

Private Industry Source: NC Department of Commerce

Source: NC Department of Commerce

Housing

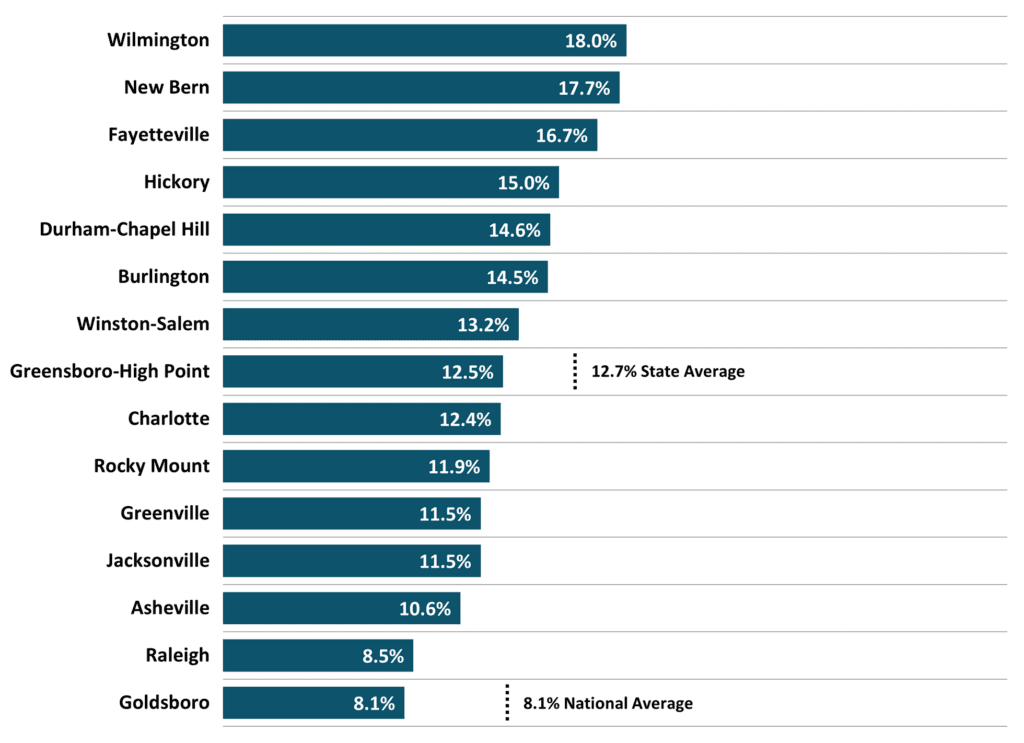

At 12.7 percent, the state of North Carolina’s same-home annual appreciation rate in the first quarter exceeded the national average of 8.1 percent (Figure 8). Wilmington metro ranked first among the fifteen state metros at 18.0 percent and New Bern metro followed closely with a 17.7 percent appreciation rate. All of the state metros were at or above the national average and seven were above the state average as well.

Figure 8

North Carolina Metros

Same-Home Annual Appreciation Rate (%)

2023 1Q

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

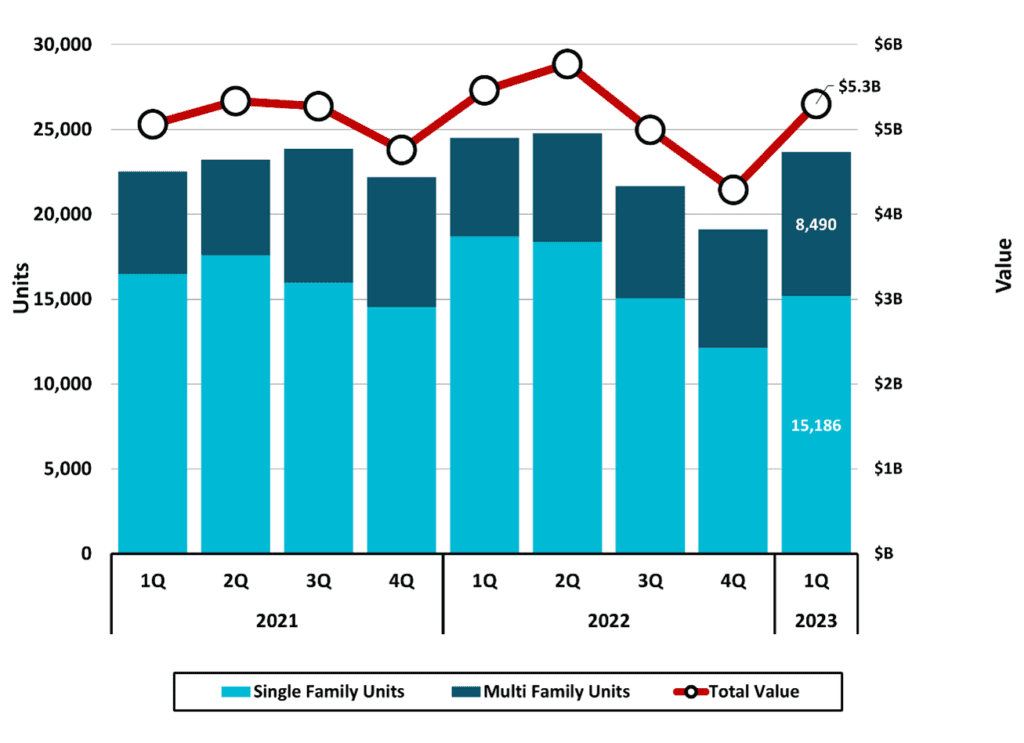

Estimated permit activity for new residential building in the state of North Carolina totaled 23,676 units in the first quarter of 2023 with a value of $5,302,104,100 (Figure 9). In percentage terms, the total number of units permitted was down 3.4 percent from one year earlier while the total value was down 2.9 percent. Permitted multi-family units totaled 8,490 and accounted for 35.9 percent of the total.

Figure 9

North Carolina

Estimated Residential Building Permits Activity*

*Based on a survey of permitting agencies. The Census Bureau provides estimates for

*Based on a survey of permitting agencies. The Census Bureau provides estimates for

any missing agency data, which typically amounts to less than 20% of the total permits.

Source: US Census Bureau

Retail Sales

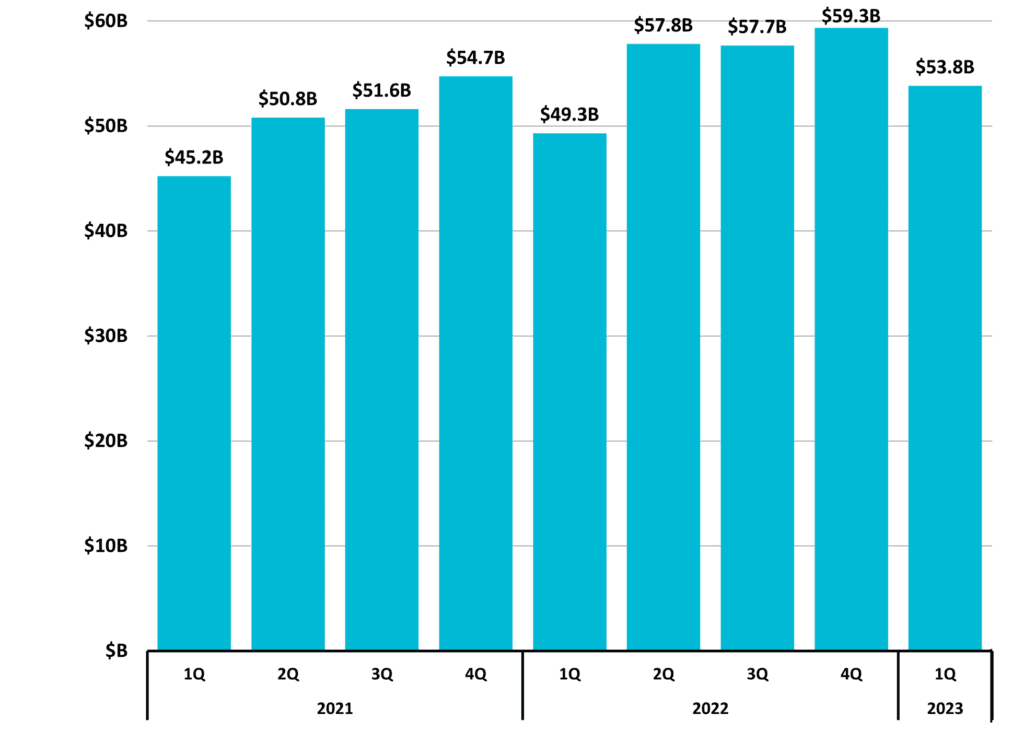

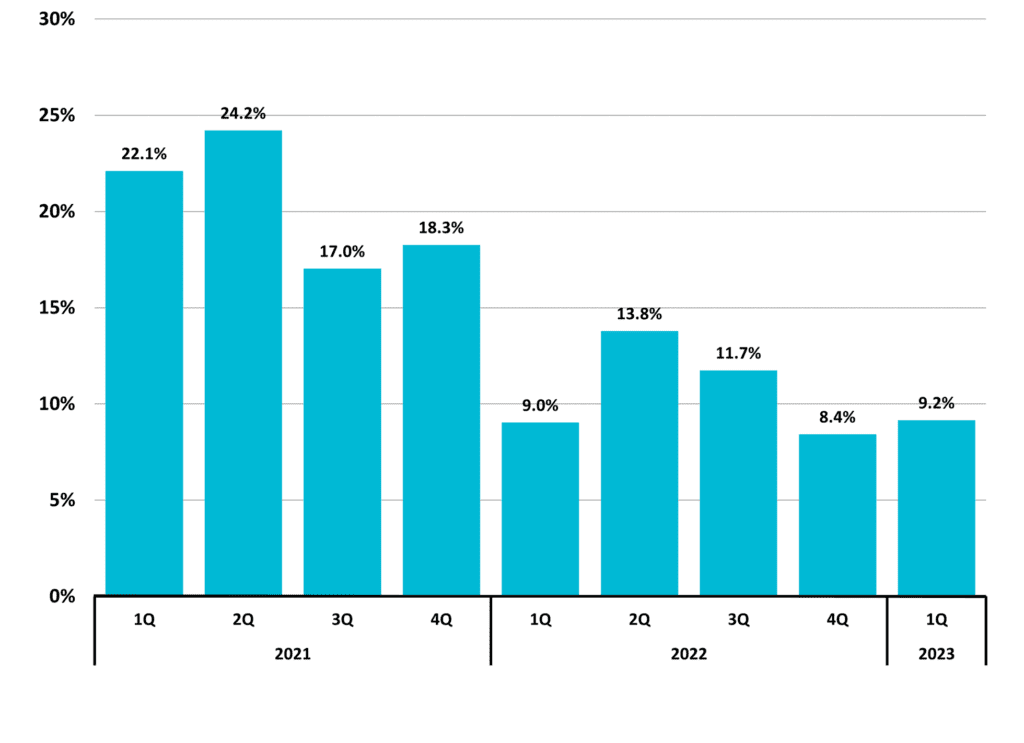

Taxable retail sales in North Carolina totaled $53,833,987,212 ($53.8 billion) in the first quarter of 2023, a 9.2 percent increase compared to a year earlier (Figure 10 and Figure 11). Looking back a span of at least 5 years, first quarter taxable retail sales have increased consistently.

Figure 10

North Carolina

Total Taxable Retail Sales

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Source: NC Department of Revenue

Figure 11

North Carolina

Total Taxable Retail Sales

Quarterly Year-to-Year Change (%)

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Includes collections of penalties, interest, and sales & use tax; and may reflect activity from prior periods.

Source: NC Department of Revenue

Special Feature:

Poverty Rate

Among the fifty states in the nation, North Carolina had the thirteenth highest poverty rate at 13.7 percent in the most current U.S. Census data (Figure 12). This was higher than the national 12.6 percent despite the state’s poverty rate decreasing steadily since 2012.

Figure 12

U.S. States

2021 Poverty Rate (%)

Source: US Census Bureau (5-Year Estimates)

Source: US Census Bureau (5-Year Estimates)

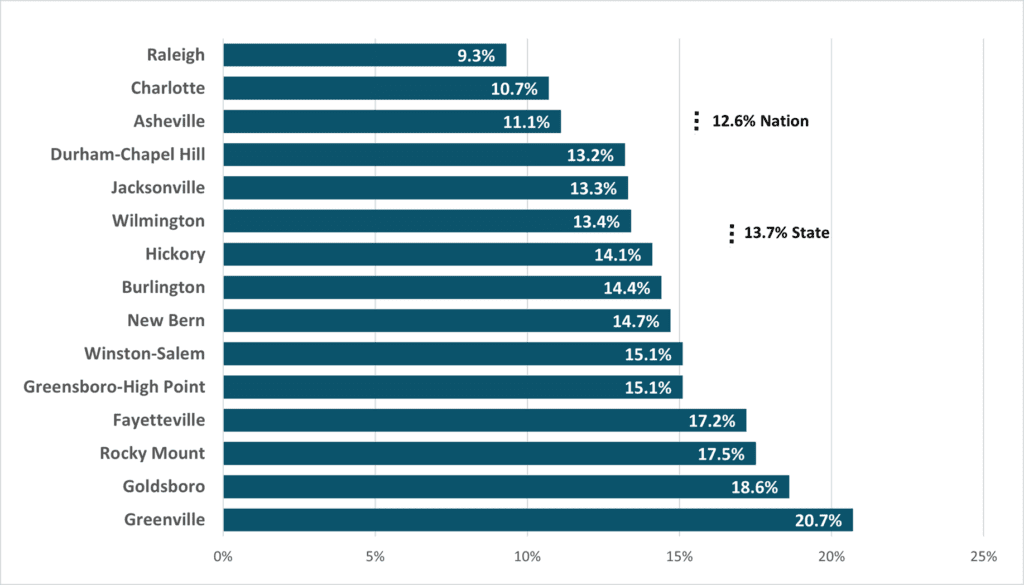

Among North Carolina’s fifteen state metros, Raleigh metro experienced the lowest poverty rate in 2021 at 9.3 percent (Figure 13). Six metros experienced poverty rates that were lower than the state’s overall 13.7 percent. Three metros had poverty rates that were lower than both the state and national rates: Asheville, Charlotte, and Raleigh.

Figure 13

North Carolina Metros

2021 Poverty Rate (%)

Source: US Census Bureau (5-Year Estimates)

Source: US Census Bureau (5-Year Estimates)

The business landscape is complex. Need help? Contact DMJPS.

For a printer-friendly version, click here.

End note: Data in this report reflects a snapshot or point in time, June 2023, and may be subject to periodic adjustment.