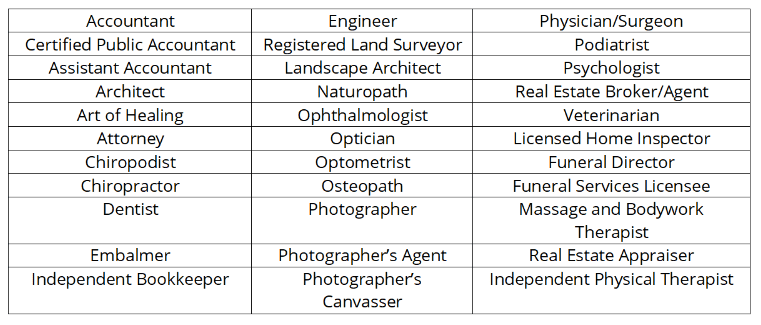

Effective July 1, 2024 the North Carolina Department of Revenue (NCDOR) has repealed the requirement for certain professions and businesses to obtain a yearly privilege license. N.C. Gen. Stat. § 105-41 is repealed pursuant to Session Law 2023-134, s. 42.7(a). Beginning July 1, 2024, professions or businesses identified in the chart below are no longer required to obtain a yearly privilege license. The chart may not reflect all specific professions and businesses.

You still are required to have a privilege license for the current fiscal year that runs from July 1, 2023 through June 30, 2024. To obtain that privilege license for this current fiscal year use Form B-202A, B202A version 2 3-04 (ncdor.gov)

What privilege taxes remain in effect?

Privilege taxes pursuant to N.C. Gen. Stat. § 105-83, which includes “[e]very person engaged in the business of dealing in buying , or discounting installment paper, notes, bonds, contracts, or evidences of debt for which, at the time of or in connection with the execution of the instruments, a lien is reserved or taken upon personal property located in this State to secure the payment of the obligations…” remain in effect. Additionally, privileges taxes pursuant to N.C. Gen. Stat. § 105-88, which includes “[e]very person, firm, or corporation engaged in any of the following businesses: (1) [t]he business of making loans or lending money, accepting liens on, or contracts of assignments of, salaries or wages, or any par thereof, or other security or evidence of debt for repayment of such loans in installment payment or otherwise; (2) [t]he business of check cashing regulated under Article 22 of Chapter 53 of the General Statutes; (3) [t]he business of pawnbroker regulated under Part 1 of Article 45 of Chapter 66 of the General Statues,” also remain in effect. For further questions please refer to DMJPS PLLC and/or NCDOR Excise Tax Division Notice dated May 24, 2024