The DMJPS Digest: A CPA Blog

Insights and musings from the desk of DMJPS professionals.

Financial Accounting Blogs for Businesses & Individuals

Are you perplexed by new tax laws and need advice on how to comply with the latest regulations? Do you want to improve your financial literacy so you can run a more efficient and profitable business? You’ve come to the right place. DMJPS PLLC’s accounting blog provides the latest insights and expert knowledge to help your business navigate a complex and ever-evolving industry.

DMJPS’ team of highly-experienced specialists provides expert advice and in-depth analysis of the latest news, trends, practices, and regulations to help you stay up-to-date on the most current developments. DMJPS’ accounting blog covers the most important financial reporting issues that affect many individuals, businesses, and organizations.

North Carolina IRC Conformity Update: What Taxpayers Should Know Now

Executive Summary Until the General Assembly updates North Carolina’s conformity statute, taxpayers should anticipate additional adjustments, added compliance complexity, and potential filing delays. Proactive planning now can help you avoid missteps and identify...

North Carolina Economic Report – 2025 Third Quarter

Highlights: DMJPS is pleased to provide the third quarter 2025 economic update across North Carolina’s fifteen metro areas. While select indicators point to moderating growth --- including a slower pace of home price appreciation --- the state’s economy continued to...

Guidance for Employers on 2025 Tip and Overtime Income

Under the OBBBA (One Big Beautiful Bill Act) of 2025, employees can now get a deduction for some of their tips and overtime for the years 2025 to 2028. While this is an employee tax break (not an employer tax break), employers have reporting responsibilities for 2025...

North Carolina Economic Report – 2025 Second Quarter

Highlights: DMJPS is pleased to provide the second quarter 2025 economic update across North Carolina’s fifteen metro areas. Despite signs of moderating growth in some indicators, the state’s economy continues to show steady expansion, marked by broad-based job gains,...

Prepare Now: IRS to Require Electronic Refunds Starting September 30, 2025

Update: On September 25, 2025, Denise Davis, Director of the IRS Taxpayer Services Division, provided additional details regarding the IRS’ transition to electronic payments for tax year 2025 filings. Key highlights include: Main focus: Shifting to electronic payments...

IRS Clarifies 2024 R&D Expensing Rules for Businesses

The 2025 Tax Act, commonly known as the One Big Beautiful Bill (OBBB), reinstated expensing of research and experimentation or development (R&D) costs. For the last three years, all taxpayers have been required to capitalize domestic R&D costs and amortize...

What It Means to “Be Greater”: Reflections from the Future of Our Profession

At DMJPS CPAs + Advisors, our internship program is about more than learning how to prepare tax returns or navigate accounting software—it’s about helping the next generation of professionals grow into who they want to become. This spring, our interns not only...

Personal Provisions of the 2025 Tax Act- The Big Beautiful Bill

On July 4, 2025, the 2025 Tax Act was enacted with the President’s signature. Formerly and commonly referred to as the One Big Beautiful Bill (hereafter, the Act), the Act passed the legislative bodies on a party-line vote of 51-50 in the Senate and 218-214 in the...

Business Provisions of the 2025 Act- The Big Beautiful Bill

On July 4, 2025, the 2025 Tax Act was enacted with the President’s signature. Formerly and commonly referred to as the One Big Beautiful Bill (hereafter, the Act), the Act passed the legislative bodies on a party-line vote of 51-50 in the Senate and 218-214 in the...

North Carolina Economic Report – 2025 First Quarter

Highlights: DMJPS is pleased to provide the first quarter 2025 economic update across North Carolina’s fifteen metro areas. The state’s economic indicators indicate continued job growth and consumer spending. Employment gains were recorded across most major...

Stay in the Know With DMJPS’ Business Accounting Articles

The world of finance and reporting often has many complex regulations that can frustrate even the best in the industry. DMJPS can simplify complicated issues to improve your understanding and help you make informed decisions. Our accounting blogs provide businesses and individuals with a wealth of guidance, insightful content, and actionable solutions to reduce impediments on your path to growth.

If you want to stay ahead of the latest developments and gain the most comprehensive insight into the world of accounting, invest your time in reading our CPA blog. DMJPS’ business accounting articles are written by our team of nationally-acclaimed specialists, offering educational resources, strategic advice, and practical solutions to help you fulfill your most pressing financial and tax obligations.

DMJPS Webinars

WEBINAR: Preparing Today for Tomorrow: Aligning Business Value and Exit Plans Webinar

Thursday, February 19 | 2 - 3 PM Presented by Sara Maddox, ABV, AM, CVA, EA

WEBINAR: Protecting Value: Structuring Business Deals for Tax Efficiency

Tuesday, January 20 | 2 - 3 PM Presented by Mike Gillis, CPA, PFS, CGMA and David Mize, CPA

WEBINAR: 2025 Year-End Tax Planning

Tuesday, November 4 | 2 - 3 PM Presented by R. Milton Howell III, CPA, CSEP and Rollin Groseclose, CPA, CGMA

WEBINAR: The Big Beautiful Bill Unpacked: Tax Planning, Compliance, and Changes for 2025 and Beyond

Thursday, July 17 | 2 - 3 PM Presented by R. Milton Howell III, CPA, CSEP and Rollin Groseclose, CPA, CGMA

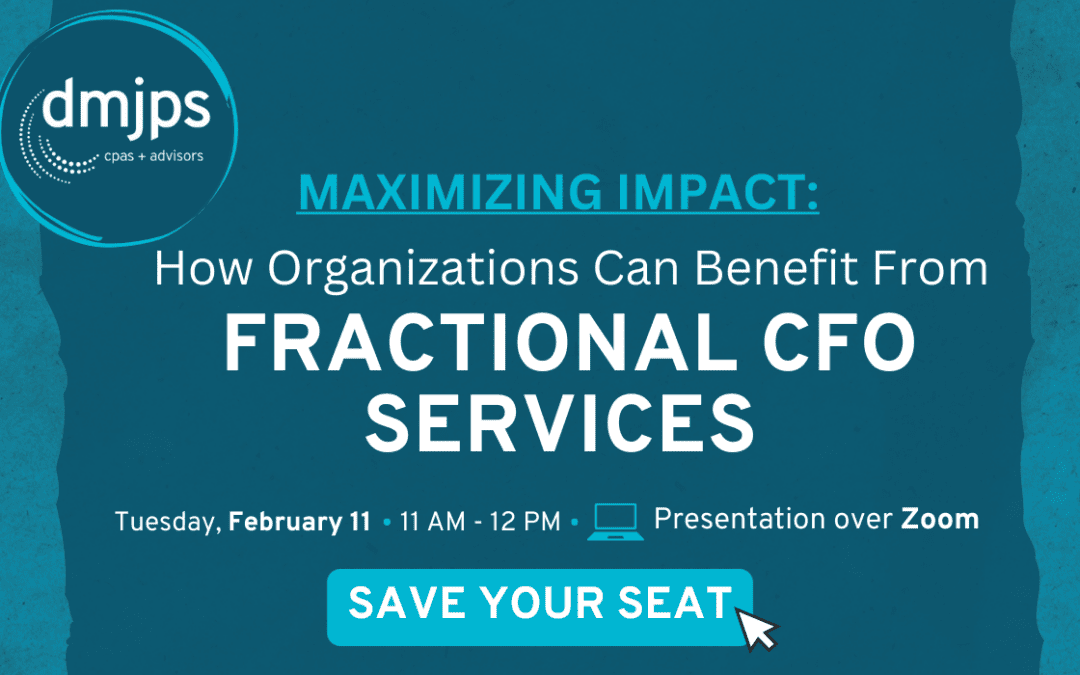

WEBINAR: How Organizations Can Leverage Fractional CFO Services

Tuesday, February 11 | 11 AM - 12 PM Presented by Jennifer Billstrom, CPA

Tax Watch

North Carolina IRC Conformity Update: What Taxpayers Should Know Now

Executive Summary Until the General Assembly updates North Carolina’s conformity statute, taxpayers should anticipate additional adjustments, added compliance complexity, and potential filing delays. Proactive planning now can help you avoid missteps and identify...

Guidance for Employers on 2025 Tip and Overtime Income

Under the OBBBA (One Big Beautiful Bill Act) of 2025, employees can now get a deduction for some of their tips and overtime for the years 2025 to 2028. While this is an employee tax break (not an employer tax break), employers have reporting responsibilities for 2025...

Prepare Now: IRS to Require Electronic Refunds Starting September 30, 2025

Update: On September 25, 2025, Denise Davis, Director of the IRS Taxpayer Services Division, provided additional details regarding the IRS’ transition to electronic payments for tax year 2025 filings. Key highlights include: Main focus: Shifting to electronic payments...

Newsletter Sign-up